Howard Lutnick’s qualifications for Treasury secretary

Howard Lutnick, as the CEO of Cantor Fitzgerald, is a respected figure in the financial world. His vast experience and leadership skills make him a suitable candidate for Treasury Secretary. Lutnick's background in finance and risk management equips him to handle the complex economic challenges facing the country. He is known for his strategic thinking and ability to navigate volatile markets successfully. His expertise in financial regulations and policy-making is a valuable asset that could benefit the nation. Lutnick's commitment to fostering economic growth and stability demonstrates his dedication to public service and the betterment of society.

Read more

Role of Treasury bills in investment portfolios

Treasury bills are low-risk, short-term investments often used by investors seeking safety and liquidity. Their stable returns can provide a cushion in volatile markets. Including Treasury bills in a diversified portfolio can help manage risk and preserve capital. These securities are backed by the government, making them relatively safe investments. Investors can easily buy and sell Treasury bills on the open market, offering flexibility. The predictable nature of Treasury bill returns makes them suitable for conservative investors. However, their yields are typically lower compared to other investments, so they may not provide significant long-term growth.

Read more

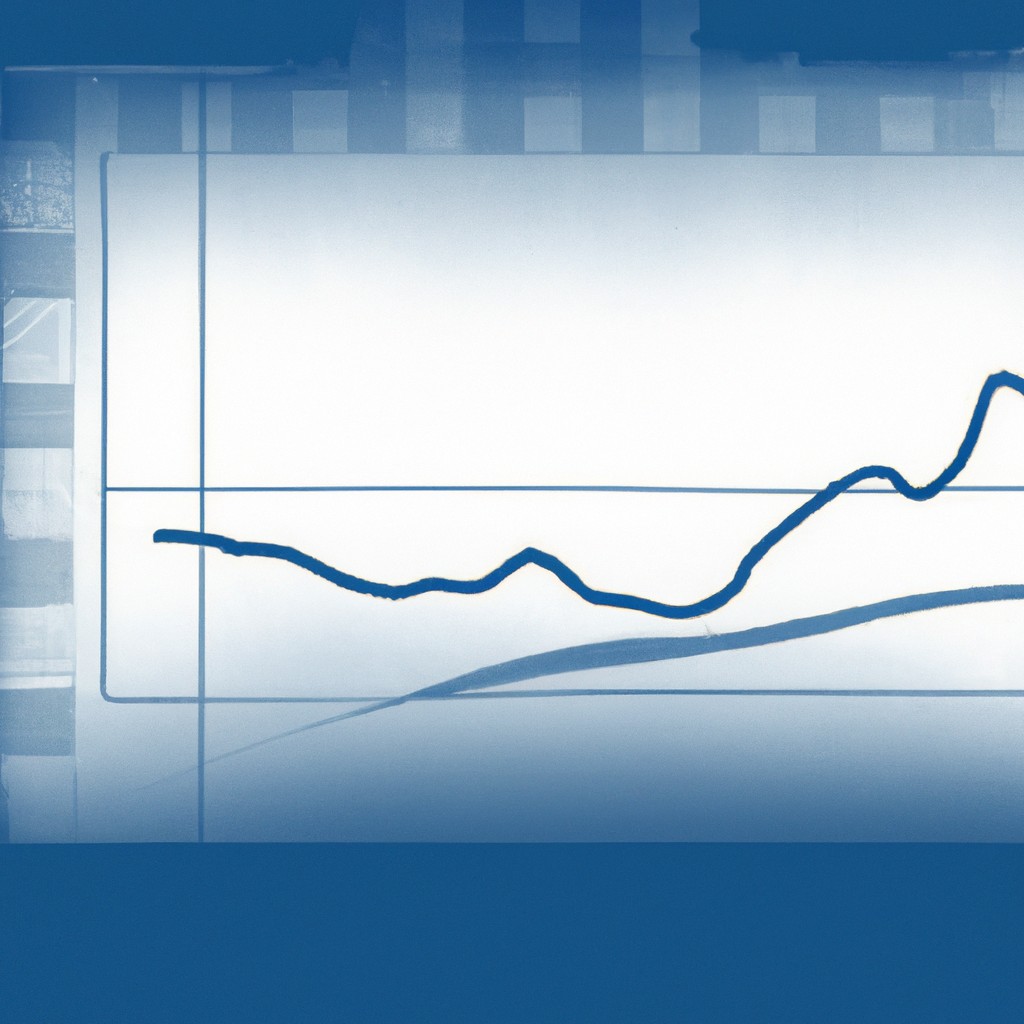

Impact of Treasury yield on stock market

When Treasury yields rise, investors worry about higher borrowing costs for businesses and individuals. This can lead to a slowdown in economic activity and lower earnings for companies. As a result, stock prices may decline as investors reevaluate their risk appetite in a higher yield environment. Conversely, falling Treasury yields can signal economic uncertainty, prompting investors to seek the safety of stocks. When bond yields drop, companies can finance growth at lower costs, potentially boosting stock prices. Thus, the relationship between Treasury yields and the stock market is crucial for investors to monitor and understand for making informed investment decisions.

Read more

Implications of rising Treasury yields on the economy

Rising Treasury yields have significant implications for the economy, affecting various sectors and individuals. Higher yields make borrowing more expensive, increasing interest rates on mortgages, student loans, and credit cards. This can discourage consumer spending and slow down economic growth. Additionally, rising yields can impact the stock market, as investors may shift their funds from equities to safer fixed-income securities. This can lead to stock market declines and reduced investment in businesses. Furthermore, rising yields can affect government borrowing costs, potentially increasing the national debt and putting a strain on the budget. Overall, the implications of rising Treasury yields on the economy are far-reaching and require careful monitoring and analysis.

Read more

Impact of declining Treasury yields on the housing market

Declining Treasury yields can have a significant impact on the housing market. When Treasury yields drop, mortgage rates tend to decrease as well. This means that potential homebuyers can secure loans at lower interest rates, making homeownership more affordable. Lower mortgage rates can stimulate demand in the housing market, leading to increased home purchases and potentially driving up home prices. Additionally, existing homeowners may choose to refinance their mortgages to take advantage of lower rates, freeing up additional income that can be used for other purposes. However, declining Treasury yields can also signal economic uncertainty, which may make some buyers hesitant to enter the housing market. Overall, the impact of declining Treasury yields on the housing market is complex and can vary depending on various factors.

Read more

Equity Markets Performance Amidst Increasing Treasury Yields

Equity markets have shown resilience despite the rising Treasury yields. Investors are closely monitoring the impact of these yields on stock prices. The increasing yields have led to a shift in market sentiment, with investors becoming more cautious. However, the overall performance of equity markets has remained positive. Companies with strong fundamentals are continuing to deliver solid earnings reports, which is bolstering investor confidence. While there have been some downward fluctuations, the market has demonstrated its ability to rebound quickly. Traders are closely monitoring economic indicators and keeping a close eye on inflationary pressures to make informed investment decisions. Overall, the equity markets are showing remarkable strength amidst the changing landscape of rising Treasury yields.

Read more

Impact of Rising Treasury Yields on Mortgage Rates

Rising treasury yields can have a significant impact on mortgage rates, affecting homeowners and potential buyers alike. When treasury yields increase, lenders often raise the interest rates they charge on new mortgages. This increase in mortgage rates can make homeownership less affordable and puts a strain on borrowers' monthly budgets. Potential buyers may also find it more challenging to qualify for a loan or afford the higher monthly payments. The impact of rising treasury yields on mortgage rates can lead to a decrease in home sales and slower growth in the housing market. It is essential for homeowners and buyers to stay informed about these factors to make informed decisions regarding their financial future.

Read more