potential impact of spot ETFs on the cryptocurrency market

Spot ETFs have the potential to significantly impact the cryptocurrency market. These exchange-traded funds allow investors to gain exposure to digital currencies, such as Bitcoin and Ethereum, without directly owning them. By creating a more accessible and regulated investment vehicle, spot ETFs could attract a broader range of investors, including institutional players. This influx of liquidity could lead to increased market stability and decreased volatility. Additionally, spot ETFs could bring more transparency and oversight to the cryptocurrency market, addressing concerns about price manipulation and fraud. However, there are also potential risks to consider, such as the possibility of market manipulation through ETFs. Overall, the introduction of spot ETFs could have a transformative effect on the crypto market, shaping its future trajectory.

Read more

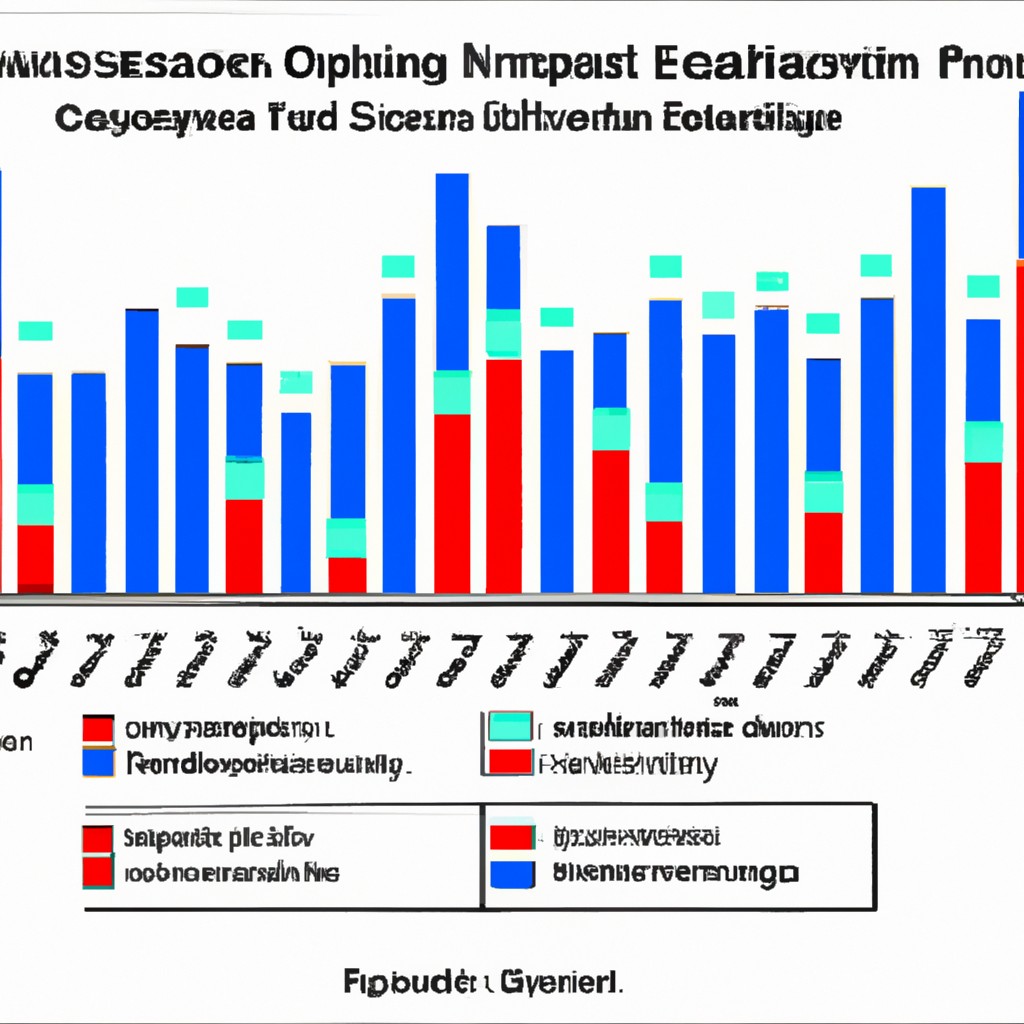

Impact of global trade tensions on China’s export market

China's export market has been significantly affected by the escalating global trade tensions. The imposition of tariffs and trade barriers by major economies has led to a decline in Chinese exports. This has created challenges for Chinese businesses, particularly in industries like manufacturing and technology. As a result, many companies are grappling with shrinking profit margins and reduced demand. Moreover, the uncertainty surrounding future trade policies has hindered investment and expansion plans. Despite these obstacles, China has been exploring alternative markets and diversifying its export portfolio. The country is also focusing on domestic consumption and innovation to mitigate the impact of global trade tensions and foster sustainable growth.

Read more

benefits of spot ETFs for bitcoin

Spot ETFs for Bitcoin offer a wide range of benefits for investors. First, they provide easy accessibility, allowing individuals to invest in Bitcoin without needing technical expertise. Additionally, spot ETFs offer liquidity, meaning investors can easily buy or sell their holdings. This enhances flexibility and reduces the risk of being unable to sell during market downturns. Furthermore, spot ETFs provide diversification by allowing investors to hold a basket of Bitcoin rather than individual coins. This spreads risk and reduces the potential impact of volatility on investments. Finally, spot ETFs offer transparency, with their holdings and prices readily available, increasing trust among investors. Overall, spot ETFs for Bitcoin offer convenience, liquidity, diversification, and transparency to investors.

Read more

The Impact of Deflation on the Economy

Deflation can significantly impact the economy by diminishing consumer spending power and business profits. It occurs when prices fall, leading to reduced demand and investment. As consumers anticipate further price declines, they delay purchases, causing a decrease in production. Businesses struggle to maintain profitability, leading to job losses and wage cuts. With decreased spending, companies may face excess inventory and liquidity problems. Additionally, deflation raises the real value of debt, making it more challenging for individuals and businesses to repay loans. Governments may resort to expansionary monetary policies but face limitations when interest rates reach zero. Overall, deflation hampers economic growth and can lead to a prolonged recession or even depression.

Read more

Strategies for Managing Deflation

Deflation can be a challenging economic situation, but there are strategies that can help manage it effectively. One approach is for central banks to ease monetary policy by cutting interest rates. This stimulates borrowing and spending, boosting demand and counteracting deflationary pressures. Another strategy is fiscal stimulus, where governments increase spending or cut taxes to encourage economic activity. Quantitative easing is also used, whereby central banks buy financial assets to inject liquidity into the economy. Lastly, structural reforms can improve productivity and competitiveness, which can help boost economic growth and counter deflationary trends. By implementing these strategies, policymakers can work towards mitigating the effects of deflation and fostering a healthier economic environment.

Read more

Strategies for Cost Cutting at Wells Fargo.

Strategies for Cost Cutting at Wells Fargo can help improve the bank's financial health. Wells Fargo must analyze their expenses thoroughly to identify areas where they can reduce costs. This could include optimizing their technology infrastructure, streamlining operations, and implementing efficiency measures. They could also look into renegotiating contracts and reducing unnecessary spending. Implementing a system for monitoring expenses and setting cost reduction targets can help them stay on track. Additionally, Wells Fargo should consider investing in training programs to enhance their employees' skills, which can lead to better productivity and cost savings in the long run. Adopting these strategies will help Wells Fargo cut costs without compromising their services.

Read more

Regulatory challenges faced by Bank of America

The Bank of America has been grappling with several regulatory challenges in recent years. These challenges arise from increased scrutiny and enforcement of regulations in the financial industry. One key challenge is ensuring compliance with anti-money laundering laws, which requires the bank to have robust systems and procedures in place to detect and prevent illicit financial activities. Additionally, the bank has faced regulatory pressure to improve its cybersecurity measures, given the growing threat of cyberattacks in the digital age. Another challenge is navigating the complex web of regulations related to consumer protection and fair lending practices, which require the bank to implement stringent policies to ensure fair treatment of customers. Overall, the bank must continuously adapt to the changing regulatory landscape to maintain its integrity and protect its customers.

Read more

new strategy to win consumers

In the competitive world of consumerism, businesses are constantly seeking new strategies to captivate and win over consumers. One innovative approach gaining traction is personalization. Recognizing that individuals desire unique experiences, companies are tailoring their products and services to meet specific needs. By analyzing data and understanding preferences, businesses can create targeted advertising campaigns, customized product offerings, and personalized customer service. This new strategy aims to forge a deeper connection with consumers, establishing loyalty and trust. Through personalization, companies can create a bond that extends far beyond a mere transaction, fostering a sense of belonging and appreciation. As competition intensifies, this approach proves to be an effective means of standing out amidst the noise of the market.

Read more

Chinese rival to Apple’s Vision Pro

The Chinese tech giant, XingTech, has launched its latest device, the XingPhone Vision Pro, aiming to compete directly with Apple's popular iPhone. The Vision Pro boasts cutting-edge features and a sleek design that rivals any flagship smartphone. With a vibrant and sharp OLED display, users can immerse themselves in stunning visuals. The powerful processor ensures smooth performance for multitasking and gaming. Its dual camera system captures stunning photos and videos, thanks to advanced image processing technology. The Vision Pro also offers enhanced security features, including facial recognition and a fingerprint scanner. XingTech's entry into the smartphone market presents a compelling alternative for consumers seeking a high-quality device with innovative features.

Read more

China’s manufacturing sector challenges amid export decline

China's manufacturing sector is facing numerous challenges as exports decline. With the global economic slowdown, demand for Chinese exports has dropped significantly. This has led to overcapacity in many industries, creating a competitive environment for Chinese manufacturers. Additionally, rising labor costs and stricter environmental regulations have put pressure on manufacturers to adapt and innovate. Despite these challenges, China's manufacturing sector is not without hope. Many companies are investing in advanced technologies such as robotics and automation to increase efficiency and reduce costs. Moreover, the Chinese government is taking steps to support domestic consumption and stimulate economic growth, which could help revitalize the manufacturing sector. It is crucial for Chinese manufacturers to embrace these changes and adapt to the evolving global market to remain competitive.

Read more