role of interest income in banks

Interest income plays a crucial role in banks, comprising the primary source of revenue. It stems from loans, investments, and other interest-earning assets. This revenue helps banks cover operational costs and create profits. The amount of interest income generated indicates the bank's financial health. Banks closely monitor interest rates and market conditions to optimize income. Additionally, interest income affects the rates they offer on deposits and loans. It serves as a barometer for the economy's overall performance and financial stability. For banks, interest income is not just a financial metric but a significant indicator of their operational success and sustainability.

Read more

Impact of lower interest income on banking profits

Lower interest income can significantly reduce banking profits, affecting overall financial performance. When interest rates drop, banks earn less on loans and investments, resulting in decreased revenue. This income reduction can lead to lower net interest margins, impacting profitability. Banks may feel pressure to seek alternative revenue sources or cut costs to maintain profitability levels. Strategies to address this challenge may include diversifying revenue streams, improving operational efficiency, or adjusting pricing strategies. Additionally, banks may need to closely monitor interest rate trends and adjust their strategies accordingly to navigate the impact on their profits effectively.

Read more

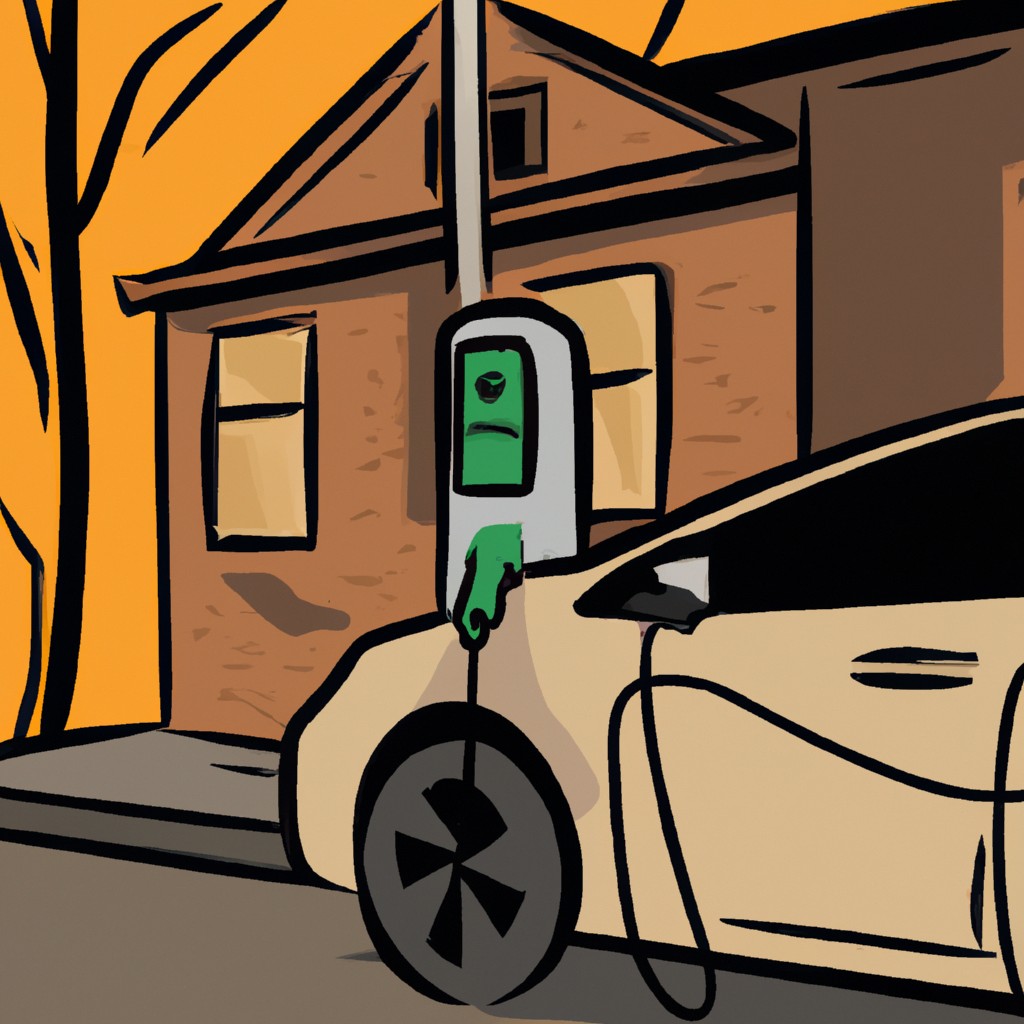

Impact of government incentives on electric vehicle adoption

Government incentives play a crucial role in boosting electric vehicle adoption rates. By offering rebates and tax credits, authorities prompt consumers to choose eco-friendly options. These incentives reduce the financial burden of purchasing electric vehicles, making them more accessible to the general public. Additionally, government-funded charging infrastructure development enhances the convenience of owning an electric vehicle. As a result, more individuals are motivated to make the switch to electric transportation, contributing to a cleaner environment and reduced carbon emissions. Ultimately, government incentives serve as powerful catalysts in accelerating the widespread adoption of electric vehicles for a sustainable future.

Read more

Growth of OpenAI in the Tech Industry

The rapid growth of OpenAI in the tech industry is stirring excitement among innovators and enthusiasts alike. OpenAI's groundbreaking research and advanced technologies have sparked conversations worldwide about the potential of artificial intelligence. The company's commitment to ethical practices and transparency sets a standard for the industry. OpenAI's collaborations with leading organizations showcase its influence and expertise in shaping the future of AI. The community surrounding OpenAI continues to expand, with individuals and businesses eager to contribute to its mission. As OpenAI continues to make strides in research and development, its impact on the tech industry is undeniable.

Read more

Benefits of owning an electric vehicle

Owning an electric vehicle offers numerous advantages. Electric cars reduce carbon emissions, helping the environment. They are cost-effective due to lower operating costs and governments offering rebates. Maintenance is simpler with fewer moving parts. Electric vehicles provide a smooth, quiet driving experience, enhancing comfort. Charging options are versatile, from home charging to public stations. Driving an electric vehicle promotes energy independence and reduces reliance on fossil fuels. Electric cars are stylish and innovative, showcasing modern technology. Owners enjoy the convenience of home charging, eliminating trips to gas stations. Battery technology continues to improve, extending driving ranges. In conclusion, owning an electric vehicle benefits the environment, wallet, and driving experience.

Read more

Benefits of AI in Investment Strategies

AI revolutionizes investment strategies by analyzing data swiftly, identifying trends, and predicting market movements accurately. This technology allows for informed decision-making by reducing human bias and enhancing efficiency in portfolio management. With AI, investors gain access to real-time insights, enabling them to seize profitable opportunities quickly. AI-driven algorithms continuously adapt to changing market conditions, providing a competitive edge and maximizing returns. Embracing AI in investment strategies cultivates a more dynamic and responsive approach to capitalize on market fluctuations. Investors leveraging AI benefit from improved risk management, increased transparency, and enhanced performance to achieve long-term financial goals effectively.

Read more

UBS challenge to Wall Street giants

UBS is invigorating the financial industry by boldly challenging the dominance of Wall Street giants. With innovative strategies, they are reshaping the landscape of traditional finance. UBS's determination and vision are inspiring a new wave of competition. Their relentless pursuit of excellence is capturing the attention of investors worldwide. By offering personalized solutions and superior client service, UBS is winning hearts and market share. As they continue to push boundaries, UBS is redefining what it means to be a global financial powerhouse. Their impact is felt throughout the industry, signaling a new era of dynamic change and fierce competition.

Read more

strategies for managing interest rate risk

One key strategy is matching assets and liabilities to reduce exposure to fluctuating rates. Regularly monitor interest rate movements to anticipate changes and make informed decisions. Utilize derivatives like interest rate swaps to hedge against unexpected rate shifts. Diversify investments across various products that respond differently to rate fluctuations. Maintain flexibility in your portfolio to adjust to changing market conditions quickly. Focus on a long-term investment horizon and avoid making impulsive decisions based on short-term rate movements. Educate yourself on different interest rate risk management techniques to be well-prepared. Seek advice from financial experts to develop a robust risk management plan.

Read more

impact on small and medium-sized banks

The evolving financial landscape poses challenges for small and medium-sized banks. Increased competition alters business dynamics. Technology advancements demand operational innovation and adaptation. Consumer preferences influence service offerings. Regulatory changes dictate compliance measures. Economic fluctuations impact growth prospects. Cost pressures affect profitability margins. Collaboration opportunities emerge with fintech partnerships. Customer relationships form the cornerstone of success. Agility and flexibility are crucial traits in navigating market trends. Strategic planning and risk management play pivotal roles in sustainable growth. Small and medium-sized banks must leverage strengths to thrive in the ever-changing banking industry. Adaptability and resilience define their journey toward sustained prosperity.

Read more

Impact of the real estate sector on the economy.

The real estate sector profoundly influences the economy, acting as a barometer of overall financial health. Its fluctuations ripple throughout various industries, impacting employment, consumer spending, and government revenues. Property construction and sales generate significant revenue streams, propelling economic growth. When the real estate market thrives, it boosts investor confidence and stimulates business activities. Conversely, a downturn in the sector can trigger economic instability and decreased consumer optimism. The sector's performance is closely linked to interest rates, regulatory policies, and market trends. A robust real estate market signals prosperity, while a weak one can signal economic challenges ahead.

Read more