Impact of Federal Reserve actions on the economy

The actions of the Federal Reserve greatly influence the economy by controlling interest rates. When the Fed lowers interest rates, borrowing becomes cheaper, encouraging businesses and individuals to spend. This increased spending boosts economic growth and creates more jobs. Conversely, when the Fed raises interest rates, borrowing becomes more expensive, leading to decreased spending and slower economic growth. The Fed's decisions can impact the stock market, inflation rates, and overall consumer confidence. Confidence in the economy can lead to increased spending, while uncertainty can cause people to hold back on investments. Overall, the Federal Reserve plays a critical role in shaping the country's economic landscape.

Read more

Characteristics of ghost jobs

Characteristics of ghost jobs include positions with uncertain tasks, lack of clear responsibilities, and minimal supervision. Workers often face isolation, unclear goals, and limited opportunities for growth. These jobs also involve unstable hours, low pay, and little job security. Employees may feel undervalued, stressed, and disconnected from the organization. Ghost jobs can lead to feelings of frustration, burnout, and alienation among workers. Lack of feedback, recognition, and support further contribute to the negative effects of these positions. In the end, ghost jobs can impact mental health, job satisfaction, and overall well-being of individuals in the workforce.

Read more

Benefits of immigration for the U.S. economy

Immigration benefits the U.S. economy by bringing in skilled workers and entrepreneurs. New ideas and perspectives foster innovation and economic growth. Immigrants contribute to various industries, boosting productivity and creating jobs. They also enhance cultural diversity, enriching society and expanding markets. Immigrant workers often fill labor shortages, sustaining critical sectors like healthcare and agriculture. Their contributions help drive technological advancement and competitiveness on a global scale. Embracing immigration promotes a dynamic and resilient economy, positioning the U.S. as a hub of talent and creativity. By recognizing the value of immigrants, the nation secures a brighter future for all.

Read more

Strategies for Successful Stock Trading

Stock trading can be complex. Start by researching companies. Diversify your investments to spread risk. Monitor market trends and news regularly. Set realistic financial goals and stick to your plan. Practice disciplined buying and selling. Analyze your performance regularly to learn and improve. Embrace a long-term perspective for sustainable success in the stock market. Remember to stay informed and adapt to changing market conditions. Building a successful stock trading strategy takes time, patience, and dedication. Stay focused on your objectives and trust in your research and analysis. With persistence and resilience, you can navigate the stock market effectively and achieve your financial goals.

Read more

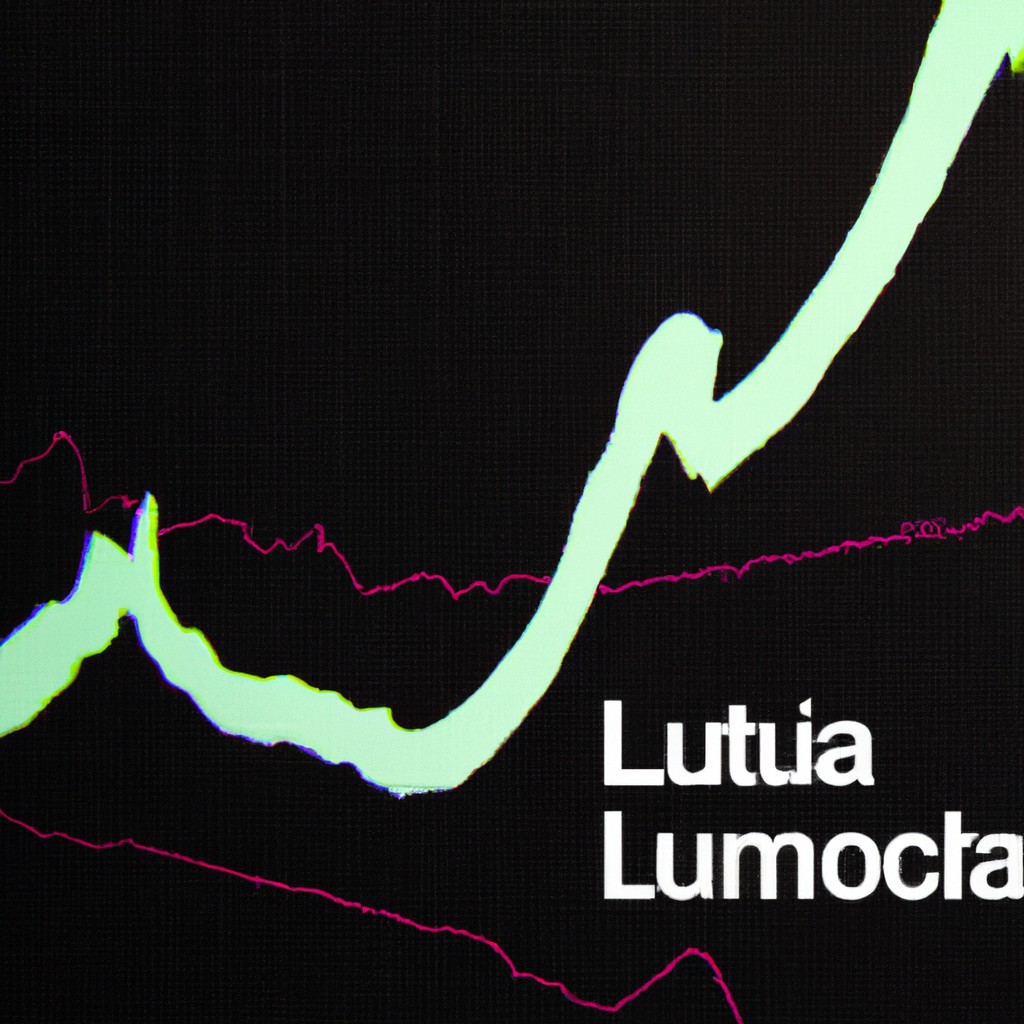

Lululemon’s financial performance after hours

After hours trading shows Lululemon's financials soaring. Investors cheer as profits surge, exceeding expectations. Analysts applaud the brand's resilience amid economic turmoil. Revenue growth impresses market watchers, fueling optimism for the company's future. Share prices rise steadily, reflecting strong investor confidence in Lululemon's performance. The athleisure giant's stock shines bright in the after-hours landscape, signaling a promising outlook for the retail sector. Lululemon's robust financial showing cements its position as a market leader, drawing admiration from both industry experts and individual investors alike. The after-hours momentum affirms Lululemon's status as a top performer in the competitive retail market.

Read more

Impact of Technology on Stock Market

Technology has revolutionized the way we interact with the stock market. Sophisticated algorithms analyze data instantly, influencing trading decisions. This fast-paced environment brings both opportunities and challenges for investors. Automation has increased efficiency but also created concerns about market volatility. Traders rely on high-speed internet connections for real-time updates and rapid transactions. Mobile apps enable instant access to market news and portfolio management. The rise of robo-advisors has democratized investing, allowing individuals to access professional advice at lower costs. Overall, technology has reshaped the stock market landscape, demanding adaptability and strategic thinking from participants.

Read more

Summary of key changes in the new Federal Reserve statement

The Federal Reserve announced key changes in its recent statement. The central bank's updated stance aims to address inflation concerns. Interest rates might see an increase sooner than expected. The Fed emphasizes its commitment to economic stability. Markets closely watch for any indications of policy shifts. Investors analyze the implications for their portfolios. Consumers monitor potential impacts on borrowing costs. The statement reflects evolving economic dynamics. Clarity in communication is crucial for market transparency. The Fed's narrative influences market sentiment. Attention is key in interpreting future monetary policy decisions.

Read more

Short-selling in financial markets

Short-selling in financial markets involves selling borrowed assets in the hope of profiting from price declines. Traders take this bold strategy to capitalize on downward market movements. However, it is a risky endeavor that requires astute timing and skillful analysis. The practice involves selling securities that one doesn't own, aiming to buy them back later at a lower price. Short-sellers bank on the belief that the asset's value will drop, enabling them to repurchase it profitably. This method can create profits in falling markets but carries substantial risks due to potential unlimited losses. Effective risk management is crucial for success in short-selling endeavors.

Read more

Impact of short-seller reports on stock prices

Short-seller reports can trigger fear among investors, leading to a rapid decline in stock prices. Market reactions are often exaggerated, causing panic selling and volatility. Companies targeted in these reports face challenges restoring investor confidence. The impact on stock prices can be significant and long-lasting. Investors should conduct thorough research and consider all factors before reacting emotionally to short-seller reports. It is crucial to analyze the credibility of the sources and the validity of the claims made in these reports. Understanding the dynamics of short-selling and maintaining a long-term perspective can help investors navigate turbulent market conditions with more confidence.

Read more

Impact of Federal Reserve on GDP

The Federal Reserve's actions directly influence the country's GDP through its monetary policy decisions. By adjusting interest rates, the Fed can stimulate or slow down economic activity. Lower interest rates encourage borrowing and spending, boosting GDP growth. Conversely, higher rates can curb borrowing and investment, leading to a slowdown in economic growth. The Fed's interventions during economic crises, such as the 2008 financial crisis, play a critical role in stabilizing the economy and preventing severe downturns. Overall, the Federal Reserve's impact on GDP is significant, shaping the country's economic performance and influencing the lives of its citizens.

Read more