Strategies for combating low inflation

To combat low inflation, central banks use various strategies to stimulate economic growth. One method involves lowering interest rates. This encourages borrowing and spending, boosting demand for goods and services. Additionally, stimulating investment through tax breaks can also help stimulate the economy. Another approach is increasing government spending on infrastructure and healthcare. This injects money into the economy, creating jobs and increasing consumer spending. Moreover, implementing quantitative easing measures, such as buying government bonds, can increase the money supply. These strategies aim to raise inflation rates and promote economic stability. By implementing a combination of these tactics, economies can effectively combat low inflation.

Read more

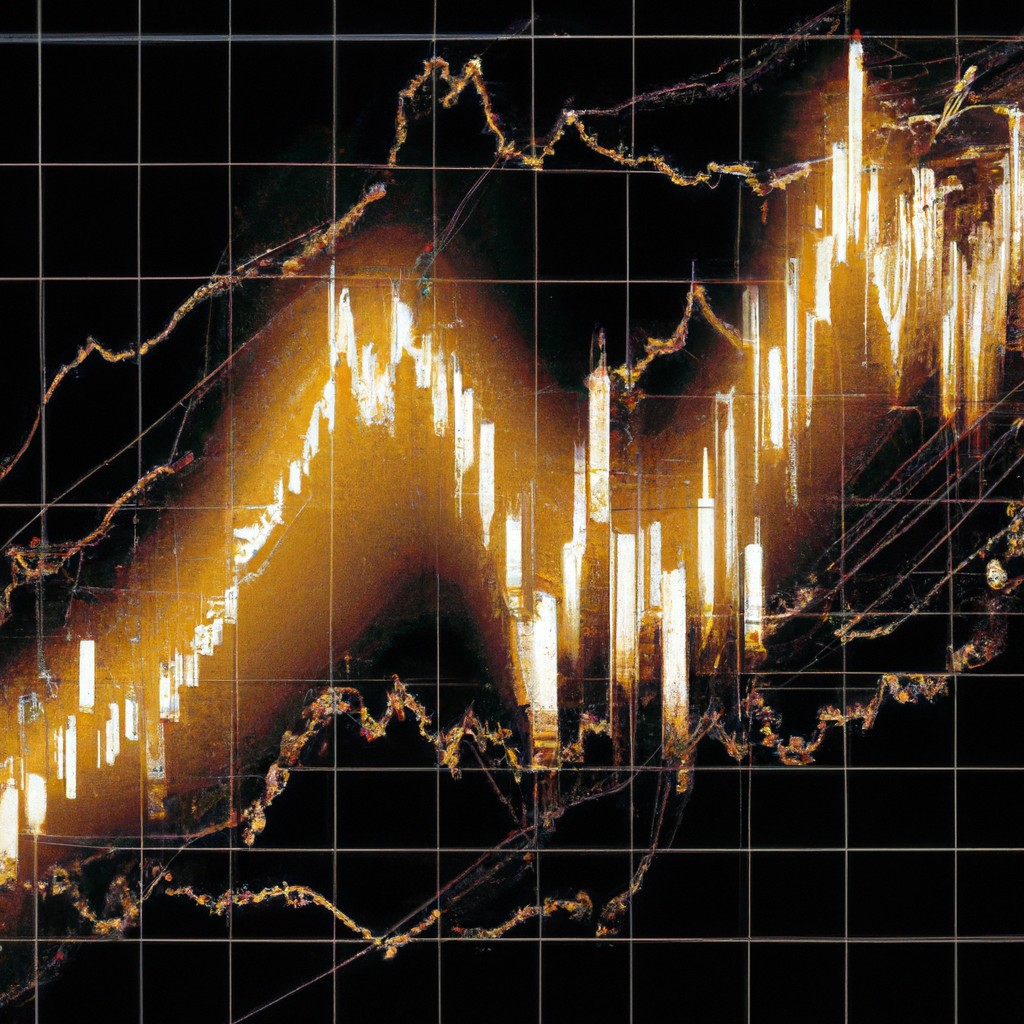

Snowflake’s after-hours trading activity

As the sun sets, Snowflake's after-hours trading sees a surge in activity. Traders eagerly await updates, monitoring every movement. The atmosphere crackles with anticipation, a dance of numbers and strategy. The market pulse quickens, a symphony of clicks and keyboard taps. Each tick on the screen carries weight, potential profit or loss. Emotions swing with each fluctuation, hope and fear intertwined. Behind glowing screens, minds race, analyzing data and trends. Decisions are made in split seconds, impacting fortunes. Amidst the chaos, a sense of thrill lingers, a high-stakes game of wits. In the after-hours, Snowflake shines brightest, a beacon of opportunity.

Read more

Nvidia’s stock performance after hours

Nvidia's stock soared after hours, surprising investors. The market enthusiastically embraced the tech company's positive earnings report. Share prices climbed steadily, surpassing expectations. Traders eagerly monitored the promising upward trend. Wall Street analysts praised Nvidia's remarkable performance. The stock market buzzed with excitement over the impressive growth. Investors eagerly awaited the next trading day. Confidence in Nvidia's future prospects was palpable. The company's successful after-hours trading reflected its strategic vision. The stock's resilience in the after-hours session intrigued market watchers. Overall, Nvidia's stock performance after hours signaled a bullish outlook.

Read more

Investor protection in fintech industry

Investor protection in the fintech industry is crucial. Regulations safeguard investors from potential risks. Transparency is essential to build trust. Investors must have access to clear information. Fintech platforms should disclose risks and rewards. Educating investors about potential pitfalls is essential. Clear communication enhances investor confidence. Secure technologies and data protection are vital aspects. Fintech companies must prioritize security measures. Investor complaints should be addressed promptly. Regulatory bodies play a pivotal role in overseeing fintech operations. Collaboration between regulators and industry players is key. Overall, protecting investors fosters a healthy and sustainable fintech ecosystem.

Read more

Benefits of remaining a public company

Remaining a public company offers ongoing access to capital markets, enabling rapid growth and expansion opportunities. Shareholders can easily buy and sell stock, creating liquidity and enhancing transparency in operations. Public companies receive widespread media coverage, boosting visibility and credibility among customers and investors. Regulatory requirements promote corporate governance and responsibility, fostering trust and accountability within the organization. Additionally, staying public allows for increased analyst coverage and research, providing valuable insights and market assessments. The public status enhances brand recognition and prestige, attracting top talent and strategic partnerships. Ultimately, remaining a public company can lead to sustained success and long-term viability in the competitive marketplace.

Read more

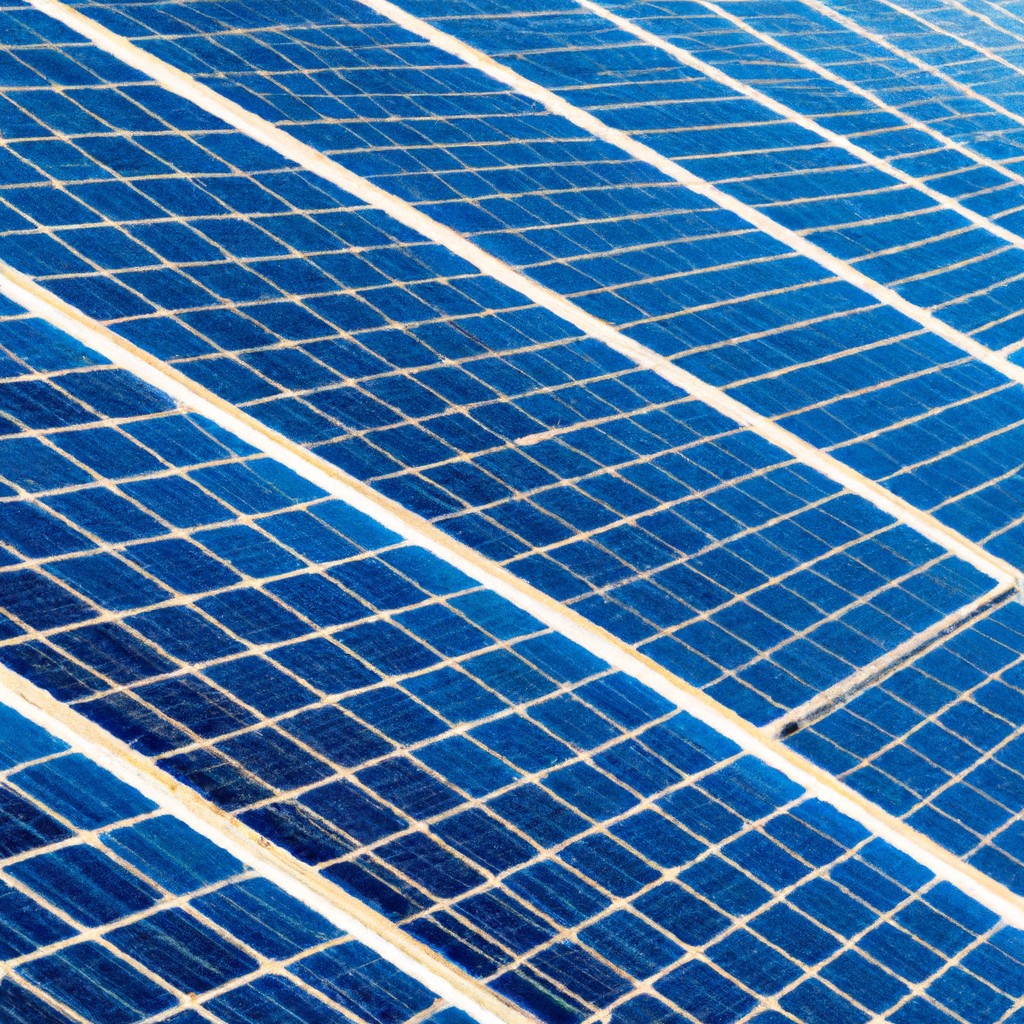

Steps to sign up for a renewable energy program

To sign up for a renewable energy program, start by researching local options available. Compare prices and benefits to find the best fit. Contact the chosen provider and inquire about the sign-up process. Have your personal information ready, such as address and contact details. Follow the instructions provided by the provider to complete the registration. Ensure you understand the terms and conditions of the program before committing. Once signed up, monitor your energy usage and note any changes. Enjoy the satisfaction of contributing to a cleaner, sustainable environment through renewable energy sources. Share your experience with others to encourage more people to join.

Read more

Real estate policies in China

Real estate policies in China aim to regulate property ownership, promote sustainable development, and curb speculation. The government implements strict measures to control rising prices and ensure affordable housing for residents. Foreign investors face restrictions but can still participate through joint ventures. The market experiences fluctuations influenced by economic factors and government interventions. Chinese citizens prioritize property investment for security and future wealth. Legal frameworks govern agreements, transactions, and property rights to protect both buyers and sellers. Accessible information empowers individuals to make informed decisions in the complex real estate landscape of China.

Read more

Macy’s turnaround strategy and financial performance

Macy's pursued an innovative approach to revamp its business, focusing on e-commerce growth and store experience enhancements. The incorporation of data analytics guided their decision-making, leading to improved customer engagement and personalized marketing strategies. This shift resulted in a notable upturn in sales and profitability despite challenges in the retail sector. Through strategic partnerships and targeted promotions, Macy's successfully attracted a younger demographic while retaining loyal customers. The company's dedication to adaptability and agility in the ever-evolving retail landscape facilitated this positive transformation. Amidst the competitive industry environment, Macy's stands as a beacon of resilience and progress.

Read more

Impact of pandemic on Lowe’s sales and growth opportunities

The pandemic significantly boosted Lowe's sales. The company saw a surge in demand for home improvement products. As more people stayed home, they invested in renovating and upgrading their living spaces. Lowe's capitalized on this trend by shifting focus to e-commerce. Despite challenges, the company found growth opportunities in online sales. The shift to digital platforms helped reach a wider customer base. Lowe's invested in improving its website and mobile app for a better shopping experience. The company also enhanced its delivery services to meet increasing online orders. Overall, Lowe's adapted to the changing landscape and emerged stronger amid the pandemic.

Read more

Impact of macroeconomic factors on stock prices

Macroeconomic factors significantly influence stock prices. Key indicators include interest rates, inflation levels, and economic growth. Accordingly, fluctuations in these factors can impact investor sentiment and overall market performance. For instance, rising inflation may lead to higher interest rates, possibly dampening stock market returns. Conversely, robust economic growth often correlates with bullish stock market trends. Understanding these relationships is crucial for investors seeking to make informed decisions. By staying abreast of macroeconomic developments, investors can anticipate market shifts and adjust their portfolios accordingly. In sum, monitoring macroeconomic factors is essential for navigating the complexities of the stock market effectively.

Read more