Georges Elhedery’s background and experience

Georges Elhedery's journey began in Lebanon, where his passion for finance bloomed. His drive and dedication led him to prestigious roles, honing his expertise. He climbed the corporate ladder through diligence and tenacity, enriching his skills. Working across various continents, his experience encompasses a vast array of markets and sectors. Georges has navigated complex challenges with strategic insight, shaping his resilient character. His leadership style inspires collaboration and innovation within diverse teams. Empathy and adaptability define his approach, fostering meaningful connections with clients and colleagues. Georges Elhedery's background exemplifies success forged through integrity, hard work, and a profound commitment to excellence in every endeavor.

Read more

Strategies for investing in bank stocks

Investing in bank stocks requires careful analysis of financial data and market trends. Look for established banks with strong track records and a history of consistent performance. Consider the bank's asset quality, profitability, and valuation metrics. Diversifying your investments across different banks can reduce risks. Keep an eye on interest rates, regulatory changes, and economic indicators that may impact bank stocks. Be prepared for volatility in the market and fluctuations in stock prices. Monitor your investments regularly and make informed decisions based on research and analysis. Seek advice from financial experts if needed to develop a successful investment strategy in bank stocks.

Read more

Ray Dalio’s investment principles

Ray Dalio, a renowned investor, emphasizes radical truth and transparency in decision-making process. By encouraging open communication, he fosters a culture of honesty and feedback among his team. Dalio stresses the importance of learning from failure and constantly seeking improvement. His investment principles revolve around embracing diversification and managing risks effectively. He advocates for thoughtful decision-making based on clear criteria and logical reasoning. As an influential figure in the finance industry, Dalio's insights on macroeconomic trends and market dynamics continue to guide investors worldwide. In summary, Ray Dalio's approach underscores the significance of strategic thinking and continuous adaptation in the world of investing.

Read more

Potential implications for future mergers and acquisitions.

In the rapidly evolving business landscape, the future of mergers and acquisitions holds significant implications. Companies will need to navigate regulatory challenges and cultural integration issues with care. The success of such endeavors may determine market leadership and financial stability. Prioritizing employee well-being and stakeholder interests can foster a positive post-merger environment. Establishing effective communication channels is vital for a smooth transition and long-term success. Strategic planning and due diligence are critical in identifying potential risks and opportunities. Embracing innovation and technology can enhance operational efficiency and competitiveness in the market. Adapting to changing consumer behavior and market trends will be essential for sustainable growth.

Read more

Perjury charges in the UK.

Perjury charges in the UK are serious offenses that involve deliberately lying under oath. It is a criminal act that undermines the justice system and can result in severe consequences for the individual found guilty. Perjury can lead to wrongful convictions, damage to credibility, and trust in the legal process. Those accused of perjury may face imprisonment, fines, and a tarnished reputation. The burden of proof is on the prosecution to demonstrate that false statements were made willfully and knowingly. Perjury cases require thorough investigation and careful consideration of evidence to ensure justice is served.

Read more

Morgan Stanley financial performance

Morgan Stanley's financial performance reflects stability and growth over the past year. Analysts point to consistent profits and strong revenue streams. Shareholders have reaped the benefits with increasing dividends and stock prices. This trend signals a robust outlook for future returns. The company's strategic investments and prudent risk management have positioned it well in a competitive market. Morgan Stanley's expansion into new markets shows promising results, attracting a broader investor base. The firm's unwavering commitment to financial excellence and client satisfaction underpins its success. Overall, Morgan Stanley's financial performance showcases resilience and potential for continued success.

Read more

Investment banking industry trends

Investment banking industry trends are continually evolving in response to market fluctuations and regulatory changes. Technological advancements, such as AI and blockchain, are reshaping how investment banks operate. Increased focus on sustainability and ESG considerations is influencing investment decisions. Remote work is becoming more prevalent in the industry, altering traditional office dynamics. Mergers and acquisitions activity is expected to rise as companies seek strategic partnerships. Diversification of services and products is a key strategy for growth and risk management. Overall, the investment banking sector is adapting to new challenges and opportunities in a dynamic global economy.

Read more

Investing in small caps

Investing in small caps can be a rewarding opportunity for investors seeking growth. Small cap companies often show rapid development because of their size. These firms have the potential to outperform larger companies in a shorter time frame. However, investing in small caps also comes with higher risks due to their susceptibility to market fluctuations. To mitigate risks, thorough research is essential. Understanding the company's financial health, market potential, and competition is crucial. Diversifying your small cap investments and being patient can help weather market volatility. In conclusion, while small caps offer significant growth potential, it's important to approach them with caution.

Read more

Inventor of Bitcoin controversy

The controversy surrounding the inventor of Bitcoin continues to intrigue and puzzle many. As rumors swirl and speculation runs rampant, the true identity of this enigmatic figure remains shrouded in mystery. Some believe it was a singular genius, while others suggest a collaborative effort. Supporters defend the notion of anonymity, emphasizing its revolutionary nature. Critics question the authenticity, raising doubts about the motivations behind such secrecy. Despite the debates and theories, one thing is certain: Bitcoin's creator has left an indelible mark on the world of finance, sparking a digital revolution that continues to shape our future.

Read more

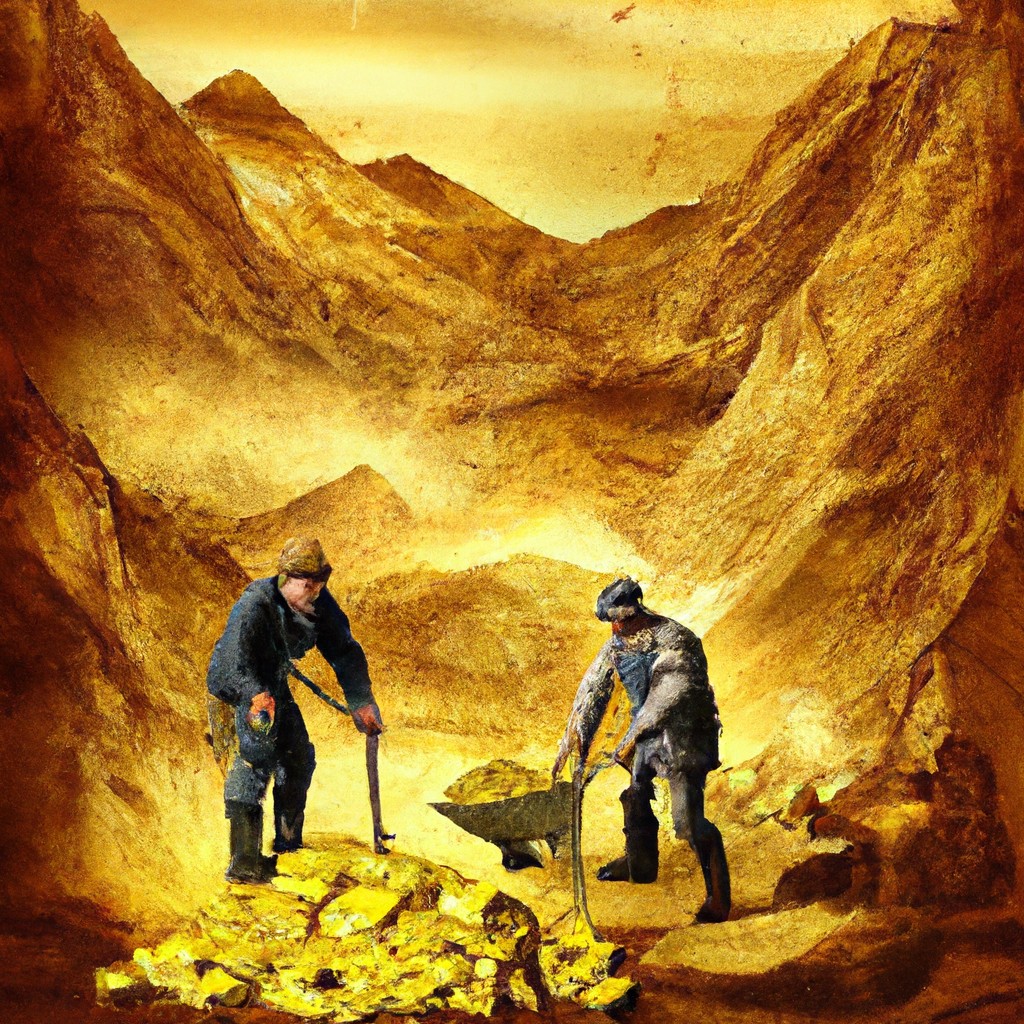

Impacts of gold on the global economy

Gold holds a unique position in the global economy. Its value impacts currencies and investments worldwide. Demand for gold influences prices and shapes market dynamics. As a safe-haven asset, it offers stability during economic uncertainties. Gold mining supports employment in many regions, boosting local economies. The gold supply chain involves various industries, creating interconnected economic relationships. Central banks hold gold reserves as a form of wealth security. Gold's historical significance and cultural symbolism contribute to its enduring appeal. The global economy continues to be influenced by the timeless allure and practical applications of gold.

Read more